LoanFinder is moments away from showing your personalized loan matches

In under 60 seconds, get matched with a personalized list of loan providers based on your needs and approval likelihood. No SIN required.

Read the terms and conditions carefully

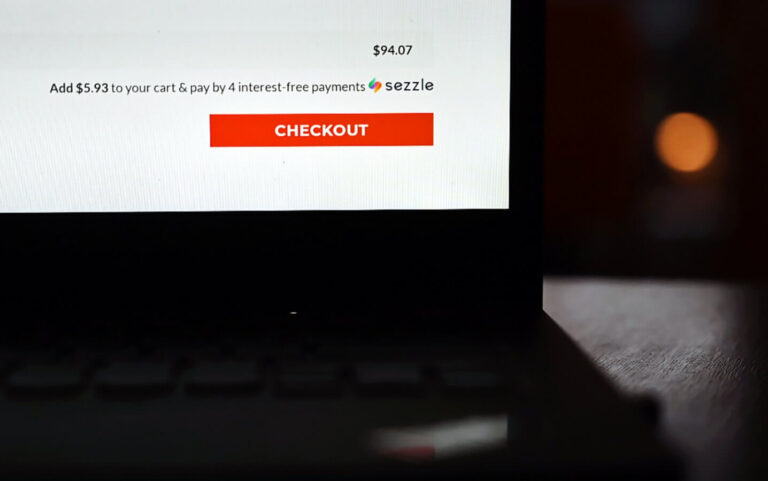

The varying approaches on credit reporting are also a reminder of the variety of other subtle policy differences between providers that consumers should consider before signing up.

Some, like Affirm and AfterPay, will halt any further purchases if a consumer falls behind on payments, while others like Klarna do the same, but could also charge a small late fee and send unpaid debts to collection agencies.

Most providers are also increasingly offering longer-term loans, with rates ranging anywhere from zero interest into the 30% range. Some are also striking partnerships for bigger-ticket items like exercise equipment and flights, making for a potentially risky transition to higher debt loads.

Just the fact that there are so many providers also raises the risk of stacking them, and having to keep track of multiple accounts of debt, said Natasha Macmillan, Ratehub.ca’s head of everyday banking. “Because of the zero-interest appeal, it almost gives people a false sense of affordability,” she said. “The real caution I would provide is ensuring that, if you do have one, or multiple, you’re looking at the total cost of all of the buy now, pay later programs that you have ongoing, to ensure that you can actually cover the cost of each of them.”

The effect of cheap loans on providers

The strain of those cheap loans is starting to show for some providers. Klarna’s most recent quarterly results showed a 17% increase in consumer credit losses, and its overall losses doubled, raising concerns it could be the start of wider industry trouble.

But the company’s credit loss rate was still only 0.54%, showing the vast majority of borrowers are still repaying their debts.

The bigger question is whether consumers are spending more than they meant to, and if money they had planned to put elsewhere is now going toward paying back those purchases.

To avoid a pile of unexpected bills, Hoyes said the key when shopping is to think ahead. “There’s nothing wrong with using a credit card or buy now, pay later or a car loan or a mortgage or anything like that. It’s when you don’t have a plan, when it becomes an impulse purchase when you’re standing at the store, that’s when you can get into a bit of trouble.”